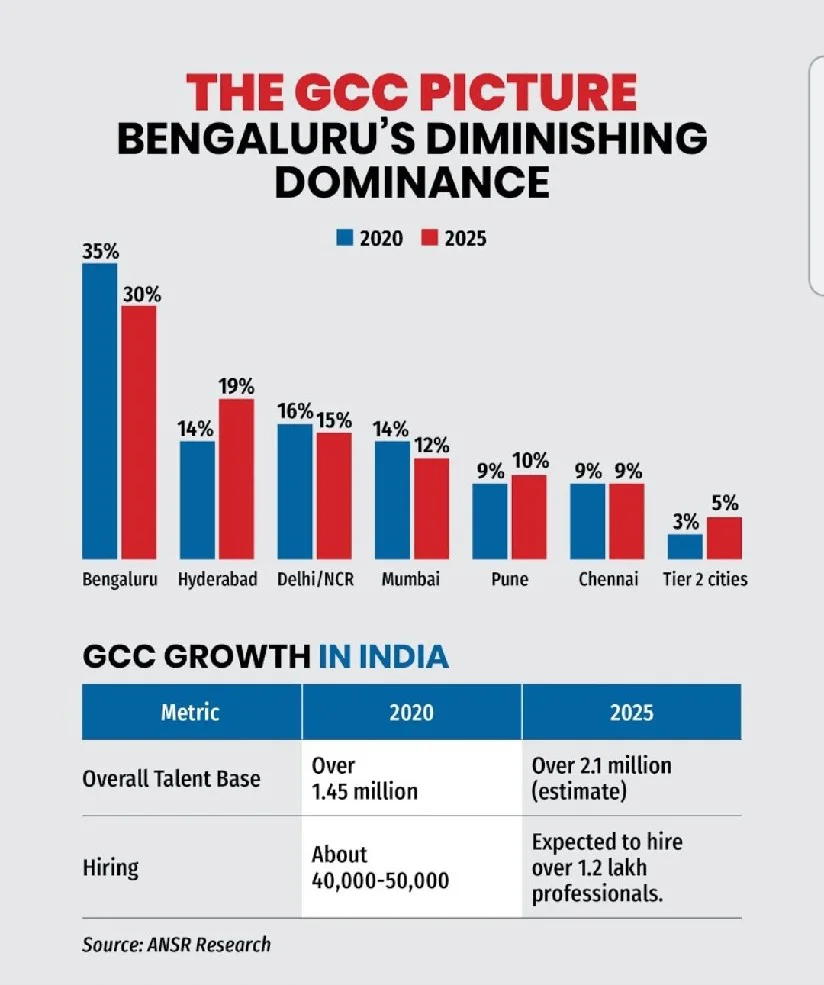

Once hailed as the undisputed capital of India’s IT and Global Capability Centre (GCC) revolution, Bengaluru is now grappling with a slow but certain shift. As Hyderabad and Tier-2 cities steadily rise, Bengaluru’s share of India’s GCC pie is slipping, from 35% in 2020 to a projected 30% by the end of 2025, according to ANSR Research. While the city still holds significant clout, its chronic infrastructure problems are prompting companies to rethink their investment strategies.

This shift is not just about buildings or bandwidth, it’s about ease, expansion, and future-readiness. Let’s dive into the forces reshaping the GCC map of India.

Bengaluru’s Infrastructure Are Expensive:

Bengaluru’s tech clusters, especially the Outer Ring Road (ORR), have reached their saturation point. What once seemed like a futuristic corridor is now marred by gridlock, water shortages, and outdated civic planning. Businesses complain that employees spend more time commuting than innovating. Even premier GCCs operating in the region are finding it harder to justify expansion within city limits.

Key challenges:

- Traffic congestion on ORR makes commute times unpredictable

- Delayed metro rail expansions around tech corridors

- Inconsistent water and power supply in peripheral areas

- Lack of coordinated planning between civic bodies and the IT industry

This isn’t just a problem for the people living there, it’s a red flag for CFOs and global leadership teams looking for long-term stability.

Hyderabad’s Proactive Policies Are Luring GCC Giants:

While Bengaluru battles infrastructure woes, Hyderabad has played its cards smartly. Telangana’s capital has rolled out red carpets for investors, not red tape. The state’s industrial policies, particularly the Telangana State Industrial Project Approval and Self-Certification System (TS-iPASS), have fast-tracked clearances and reduced bureaucratic delays.

Why Hyderabad is gaining traction?

- Proximity of office parks to residential hubs reduces commute time

- TS-iPASS has cut approval time for new GCC setups to under 15 days

- Investment in fiber connectivity and uninterrupted power

- Government-led dialogue with IT majors ensures policy alignment

Hyderabad’s narrative is simple: “You focus on talent and innovation. We’ll take care of the rest.”

Tier-2 Cities Offering a Fresh Canvas for Growth:

The pandemic forced a decentralization of workspaces, and that window of opportunity has become permanent for many firms. Tier-2 cities like Coimbatore, Visakhapatnam, and Chandigarh are becoming attractive not just for cost reasons but also for talent access, better work-life balance, and real estate savings.

Emerging Tier-2 advantages:

- Salaries are 20–30% lower without sacrificing skill quality

- Younger workforce prefers staying closer to their roots post-COVID

- New infrastructure projects funded by central schemes

- Real estate costs are 50–60% lower than Bengaluru or Hyderabad

In the GCC playbook, Tier-2 cities are no longer just “Plan B.” They are becoming mainstream destinations for backend operations and even niche tech units.

Tech Talent Migration Patterns Are Reshaping GCC Site Decisions:

Bengaluru’s appeal to top tech talent is undeniable, but recent trends show a growing willingness among skilled professionals to relocate or even stay rooted in Tier-2 hometowns. The pandemic normalized remote work, and now, the need to live in a high-cost city like Bengaluru to work at a GCC is no longer mandatory. This shift is quietly but powerfully changing how companies plan their footprints.

Key takeaways:

- Professionals now prioritize quality of life over legacy brand locations

- Companies see lower attrition rates in newer, regional GCC setups

- Talent from NITs and private universities prefer returning to home states

- Bengaluru risks brain drain unless it fixes urban issues

In recent surveys, nearly 40% of mid-level tech workers in Bengaluru expressed openness to moving to cities with better affordability and quality of life. For many, long commutes, high rents, and daily stress have diluted the charm of India’s Silicon Valley. On the other hand, cities like Hyderabad offer better planning, while Tier-2 cities present a “closer to family” advantage.

This migration of minds could be a slow leak in Bengaluru’s talent pipeline, subtly shifting the balance of power toward rising cities.

ESG and Sustainability Goals Making Bengaluru Less Attractive:

Today’s GCCs don’t just look for talent and tech, they also measure a city’s alignment with Environmental, Social, and Governance (ESG) values. Unfortunately, Bengaluru’s mounting pollution, water scarcity, and waste management failures are setting off alarm bells among global stakeholders who are increasingly ESG-conscious.

ESG-related disadvantages Bengaluru faces:

- Declining air quality index (AQI) across tech corridors

- Limited incentives for green buildings or renewable energy setups

- Poor waste segregation and recycling infrastructure

- Water insecurity driving up operational overheads

A GCC executive from a US-based Fortune 500 firm recently pointed out that annual water tankering costs in their ORR campus have doubled, raising questions during their global board review. In contrast, Hyderabad is investing in smart grids, solar-powered campuses, and treated water reuse in industrial zones winning it ESG points and investor goodwill.

In a world where boardrooms measure carbon footprint alongside quarterly growth, cities like Bengaluru must urgently rework their civic policies. Sustainability is no longer just a checkbox, it’s a competitive advantage that Bengaluru risks forfeiting.

Real Estate Saturation on ORR Driving Away Fresh Investment:

Outer Ring Road, once Bengaluru’s pride, is now a victim of its own success. With land parcels becoming scarce and rents skyrocketing, new investors are choosing to look beyond. Even existing players are weighing the cost of upgrading facilities versus relocating altogether.

The ORR crisis in numbers:

- Grade-A office rentals on ORR rose 18% in the past 3 years

- Vacancy rates for large floor plates are below 5%, creating supply crunch

- Parking, amenities, and expansion flexibility are major concerns

Companies like Wells Fargo and Goldman Sachs, once focused on ORR, are now establishing newer GCC campuses in Hyderabad and Pune for operational resilience.

Employee Experience: A Deciding Factor in GCC Shifts

GCCs don’t just follow infrastructure, they follow talent, and talent is increasingly unhappy with Bengaluru’s quality of life. Rising rents, long commutes, air pollution, and civic issues are leading to higher attrition and lower satisfaction scores in employee surveys.

Shifts driven by employee sentiment:

- Bengaluru’s average one-way commute time is over 1 hour

- Quality-of-life surveys place the city below peers in air and water quality

- Millennials and Gen Z employees are demanding flexibility and liveable cities

When retention becomes tough, GCCs start losing their edge and cities that offer better work-life balance begin to win.

Government Inertia Slowing Bengaluru’s Comeback:

Bengaluru hasn’t been idle. New metro lines, flyovers, and peripheral ring road proposals are all on the table. But execution is lagging. Delays in project clearances, land acquisition troubles, and lack of centralized planning are putting brakes on recovery.

Recent government misses:

- Peripheral Ring Road project delayed for over a decade

- No single-window clearance for IT parks or commercial setups

- Inadequate coordination between BBMP, BDA, and state agencies

Hyderabad, by contrast, has built a brand around agility. And that’s hard to compete with when your paperwork is still sitting in someone’s office.

Investor Confidence Shifting Toward Hyderabad and Tier-2 India:

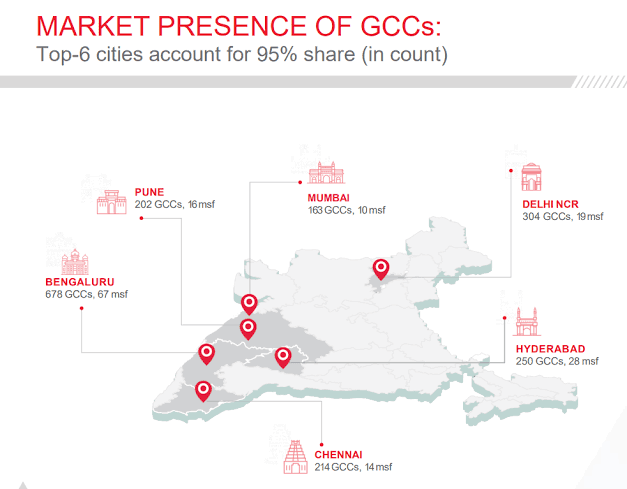

The data doesn’t lie. GCC mandates that once defaulted to Bengaluru are now split between Hyderabad and emerging cities. Companies are diversifying locations not just for cost or talent but for long-term resilience.

Key indicators of the shift:

- Hyderabad added over 15% more GCC floor space in the last 2 years

- Tier-2 cities have seen a 28% spike in GCC project announcements

- Bengaluru’s market share slipped from 35% to a projected 30% by 2025 (ANSR Research)

This isn’t an overnight fall, but a slow slide and unless Bengaluru reforms fast, this trend will only deepen.

Will Bengaluru Bounce Back or Fall Further?

All is not lost. Bengaluru still holds unmatched brand value, an established ecosystem, and access to top-tier tech talent. But it’s on a clock. Without urgent infrastructure reforms and collaborative governance, the city risks losing more ground to agile challengers.

For a turnaround, Bengaluru must:

- Execute metro and road projects on war footing

- Offer tax and land incentives like its competitors

- Prioritize liveability as a policy goal, not a side note

- Create an empowered tech city task force to cut red tape

The next 2–3 years will define whether Bengaluru retains its Silicon Valley badge or becomes a cautionary tale.

Conclusion:

Bengaluru’s legacy in the GCC space is unchallenged, but its future isn’t guaranteed. Hyderabad has become a fast-moving competitor, and Tier-2 cities are no longer underdogs. The shift is not just economic, it’s emotional. If Bengaluru can’t improve infrastructure and quality of life, it risks being remembered more for what it was than what it could be.

FAQs:

A Global Capability Centre (GCC) is a captive unit set up by global firms to manage IT and business operations. Cities benefit from job creation, foreign investment, and ecosystem development.

Bengaluru faces major infrastructure issues, traffic, real estate costs, delayed metro projects, which make it less appealing to companies compared to Hyderabad and Tier-2 cities.

Cities like Coimbatore, Chandigarh, Indore, and Visakhapatnam are emerging due to better work-life balance, lower costs, and improving infrastructure.

Hyderabad’s government has offered fast-track approvals, robust infrastructure, and strategic planning that appeal to investors looking for efficient setups.

Yes, but it needs focused infrastructure reform, better governance, and improved liveability to compete with faster, more efficient cities.